How To Calculate Additional Ctc 2025 Irs. The maximum credit is set to increase with inflation in 2025 and 2025. The child tax credit (ctc) can reduce the amount of tax you owe by up to $2,000 per qualifying child.

Fortunately, the government provides the actc, allowing up to $1,600 per child ($1,700 for tax year 2025) to become a refund when you file taxes. The child tax credit (ctc) can reduce the amount of tax you owe by up to $2,000 per qualifying child.

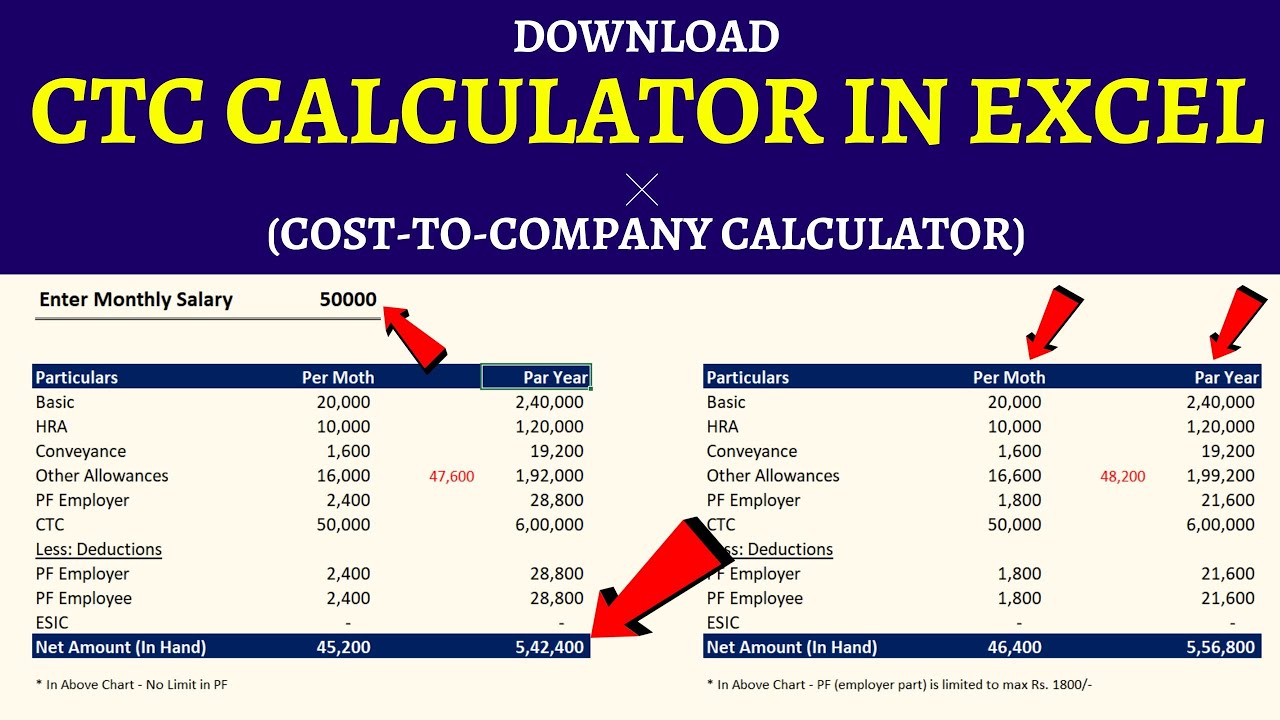

Download CTC Calculator in Excel 📊 Calculator) YouTube, The 2025 child tax credit calculator is created for fast estimating the ctc , you can avail in the tax year 2025 when the ctc rules are not same as the tax year 2025. Eligible filers can claim the ctc on form 1040, line 12a, or on form 1040nr, line 49.

SALARY 2025 How to Calculate CTC, Salary & Tax 2025 New, The child tax credit (ctc) can reduce the amount of tax you owe by up to $2,000 per qualifying child. Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax.

Online Monthly Salary To CTC Calculator 2025, House ways & means markup tax relief for american families and workers act of 2025 today. The next funding expiration deadline is march 1.

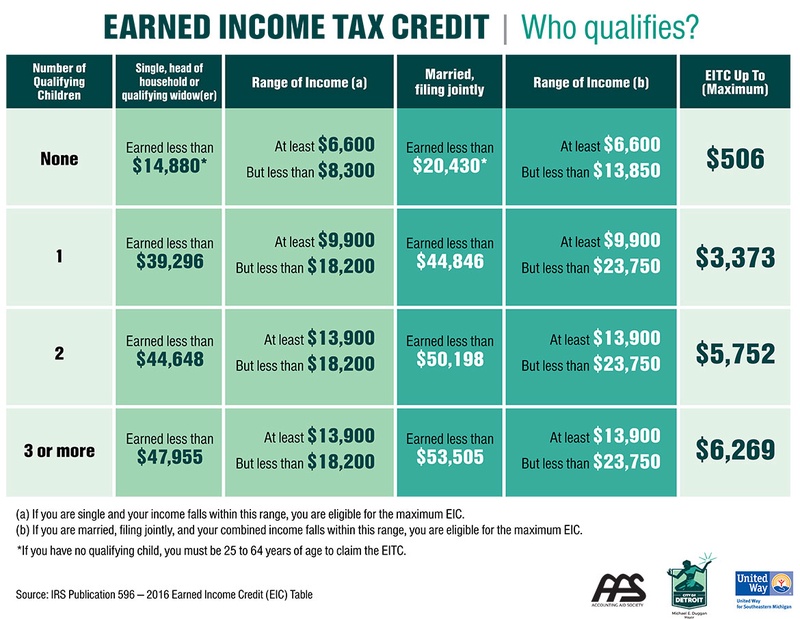

20242024 Tax Calculator Teena Genvieve, How much is the new child tax credit? Get the latest irs guidelines for the 2025 eitc and child tax credit changes.

How to Calculate Payroll Taxes, Methods, Examples, & More (2025), The child tax credit ( ctc ) will reset from a maximum of $3,600 to $2,000 per child for 2025 and. Before we get into calculating the child tax credit, let's spend a bit of time understanding it.

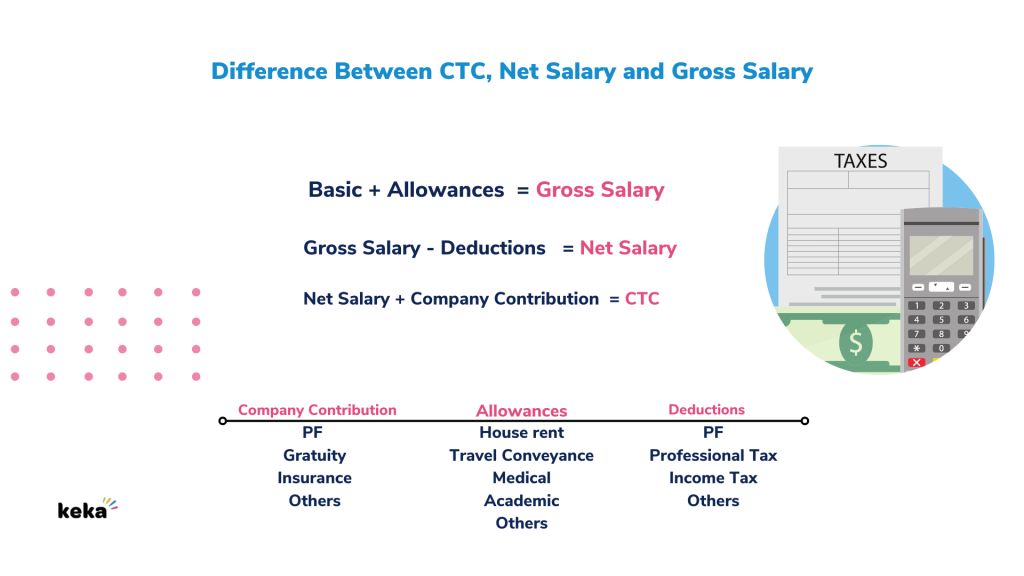

What is Cost to Company { CTC } ? Meaning & Definition Keka HR, Learn how to qualify and maximize your refund when you file taxes for the 2025. Fortunately, the government provides the actc, allowing up to $1,600 per child ($1,700 for tax year 2025) to become a refund when you file taxes.

TAX CREDITS 2025, EITC, CTC, ACTC 2025 IRS TAX REFUND UPDATE YouTube, If you end up owing less tax than the amount of the ctc, you. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc).

The Ultimate Guide to Help You Calculate the Earned Credit EIC, The ctc and odc are. To help you determine exactly how much of the credit you qualify for, you can use the child tax credit and credit for.

2025 Child Tax Credit Calculator Internal Revenue Code Simplified, See section below for a potential 2025 expansion to ctc payments. The additional child tax credit allows you to receive up to $1,600 of the $2,000 ctc per child as a refund for 2025 and 2025.

Download IRS TAX REFUND 2025 IRS REFUND CALENDAR 2025 ? EITC, CTC, Additional child tax credit amount increased. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc).

Fortunately, the government provides the actc, allowing up to $1,600 per child ($1,700 for tax year 2025) to become a refund when you file taxes.